As part of its growth series releases, WineGB can reveal that there are now 1,030 vineyards in the UK, a 9.2% rise since the last annual report, according to new figures from the Food Standards Agency Wine Team. In addition, last year English and Welsh wine sales grew by 10% from 2022.

Vineyards and Production

In 2023, 87 new vineyards were registered bringing the total number to over 1,000 for the first time. Government data also shows that winery numbers have risen from 209 to 221 and that the total area under vine now stands at 4,209 hectares, representing a growth rate of 123% in 10 years.

Production returns supplied to the Food Standards Agency Wine Team confirmed early estimations in the WineGB Harvest Report that 2023 had been a record year. Official figures for production in 2023 totalled 161,960.84 hectolitres, the equivalent of 21.6 million bottles, up 77% on 2022. While last year’s volume growth was significant, the UK’s marginal climate will continue to deliver vintage variability with the production five-year average up from 10.7 million to 12.4m bottles.

Sales

WineGB’s data shows that sales of English and Welsh wine continue to grow sustainably and manageably as new plantings come into production. Sales rose 10% last year to reach 8.8m bottles. Over a five-year time horizon since 2018, sales have consistently risen.

- Sales of sparkling wine have risen 187% since 2018, from 2.2m bottles to 6.2m in 2023.

- Sales of still wine have increased by 117% over the same period, from 1.2m to 2.6m bottles.

This growth is even more impressive as it is against the wider trend of falling UK and global wine consumption.

WineGB has declared 2024 to be the ‘year of growth’ with the launch of the WineGB Manifesto for Growth. With growth as its number one priority, WineGB is actively supporting the UK wine industry to accelerate its expansion. This is being actioned through targeted support for wine tourism, the UK market, and exports as well as the creation of working groups to harness the industry’s collective expertise and develop a coherent narrative to support sales. Through presence at domestic and international trade shows, WineGB is creating the framework that enables producers to find new routes to market.

The large production volume achieved last year is reassuring as it will enable our burgeoning wine producers to build up their stocks of reserve wine for use in non-vintage and multi-vintage sparkling wines, and for the small but growing category of NV/MV still wines. Reserve wines facilitate the creation of consistent products year-on-year. Stocks of these wines can take decades to develop, and they allow for greater wine complexity and more blending options for winemakers. As a young industry, building these stocks remains vitally important. A greater future supply of wines will also open up new markets and sales channels, allowing wineries to fulfil and commit to more accounts and distributors / retailers with higher volume demands.

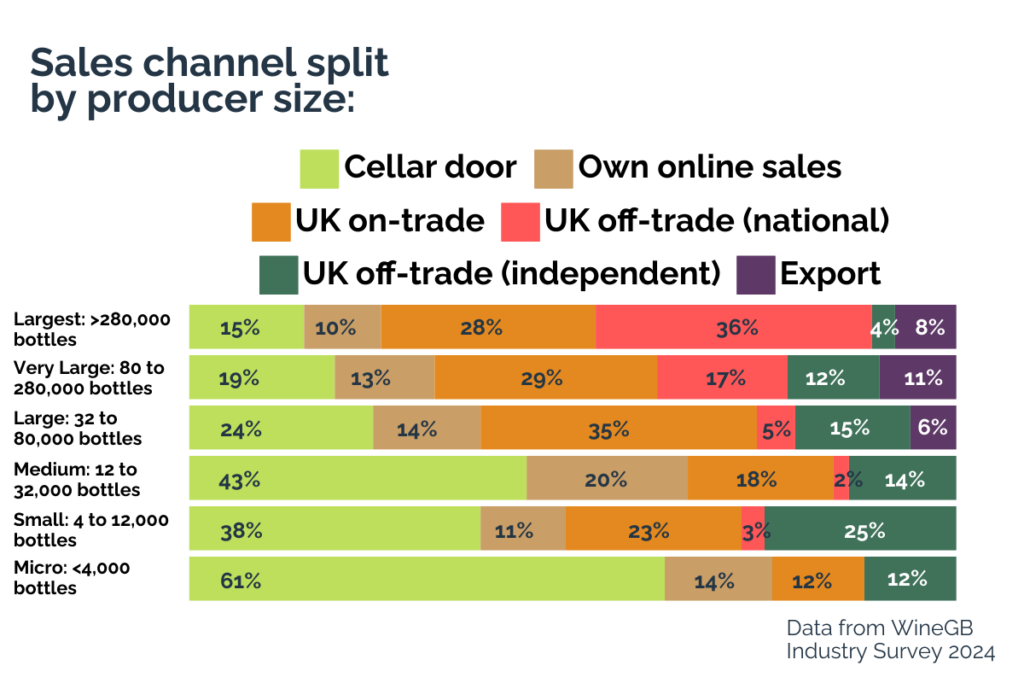

Last year, the sales channel mix stabilised and reflected the market dynamics post pandemic. Sales in the UK on-trade grew to 28% of total volume (up from 22% in 2022). Exports continue to grow as a percentage of total sales, rising to 8%. Cellar door sales (17%), producer online sales (11%), and UK off-trade national accounts (30%) remained static while there was a slight reduction in UK off-trade independent retail (6%).

WineGB data found that wineries producing over 32,000 bottles a year were less reliant on direct-to-consumer sales and had a larger share of trade sales, particularly the on-trade. Micro, small, and medium producers (up to 32,000 bottles) sell more wine directly to the consumer and through independent retail, and due to volume constraints, only sell a small percentage through national trade accounts.

The sustainable growth of the GB wine sector is reflected in the diversification of vine plantings, opening up the future market for different wine styles. Government data showed that 51 different grape varieties were planted last year, and the UK is now home to over 90 grape varieties. While Chardonnay, Pinot Noir, and Pinot Meunier continue to dominate the viticultural landscape, their planting share has slightly decreased from 71% of total plantings in 2021 to 68% in 2023. However, the top five varieties (Chardonnay, Pinot Noir, Pinot Meunier, Bacchus and Seyval Blanc) still form the majority of new plantings (185ha), compared to the next 10 with 55ha and all other varieties with 49ha. The hybrid growth trend continues, with such varieties now constituting 8% of total plantings. Top hybrid varieties include Seyval Blanc, Solaris, Rondo, and Regent.

| Grape Variety | Hectarage and percentage of planting |

| Chardonnay | 1,331ha, 32% |

| Pinot Noir | 1,157ha, 27% |

| Pinot Meunier | 379ha, 9% |

| Bacchus | 324ha, 8% |

| Seyval Blanc | 127ha, 3% |

| Solaris | 110ha, 3% |

| Pinot Noir Précoce | 73ha, 2% |

| Pinot Gris | 69ha, 2% |

| Reichensteiner | 67ha, 2% |

| Rondo | 66ha, 2% |